The financial markets have been breaking up the monotony of the bull run we have enjoyed for the last two, arguably six, quarters. We are seeing a market correction happen in light of all the coronavirus news which has the media in a frenzy. With everything going on, how can you as an investor make the best of the current market downturn. Here are a few tips I’d like to share on how to build wealth during a market downturn and my thoughts on them.

If you have a long time horizon for your invested dollars (7-10+ years) then buy, buy, buy! I’m often asked what to do when the market is falling and typically hear “I don’t want to lose any more money.” First of all, you only lose money when you sell your investments at a loss. The gains or losses while you are holding the investments are called “unrealized gains or losses” which means they are just calculations at that given point in time. You don’t “realize” the gains or losses until you offset your position in that investment. Secondly, here in Northeast Wyoming I work with many hunters, myself being one, so I ask the question “If Cabela’s or Sportsman’s Warehouse was to put on a sale where everything was 10% off, 40% off, or 70% off, what would you do?” The common answer I get is go buy new hunting gear for the upcoming seasons. I explain the market is the same way. The S&P index is having a 12%+ off sale, so buy, buy, buy!

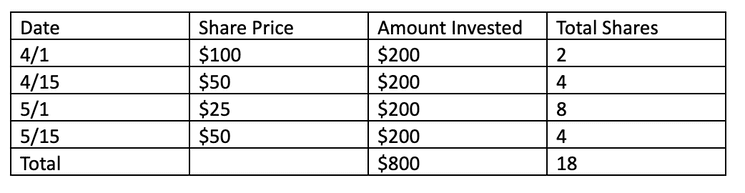

Along those same lines, there is a mathematical rule in investing called Dollar Cost Averaging , which can be a huge benefit during market corrections. Many people systematically contribute to their retirement accounts, college savings accounts, or save money every month or every two weeks. This systematic savings not only builds the habit of paying yourself first (more on that in another article), but also lays the foundation for a great advantage during market dips. Here’s how it works: Dollar cost averaging says that the average cost per share is cheaper than the average price paid per share. Here is an example:

In this example, the share price would have dropped and rebounded some but not completely up to the original level. The average share price over the six weeks was $56.25 ($100 + $50 + $25 + $50 / 4) but the average cost per share is only $44.44 ($800 / 18 shares). Therefore, by systematically investing, you are able to buy the investment for a lower average cost per share.

Outside of price corrections, the overall economy remains looking quite healthy. The latest jobs report from the BLS showed that total Nonfarm payroll employment rose by 273,000 jobs in January and unemployment remained little changed (BLS). There doesn’t seem to be a bubble of any kind in our economy such as the housing bubble of 2008 or tech bubble of 2001. Mortgage rates have dropped dramatically and are near their 52-week lows and the Feds just dropped the interest rates by 0.50%, but the bond yield curve remains fairly steady and has not inverted (WSJ). Although rate cuts are not necessarily positive signs for the economy, to you as the consumer, this can be advantageous if you have debt which needs refinanced as part of your financial plan.

So how can you be opportunistic during these turbulent times? First of all, if you are systematically investing money – don’t stop, just keep putting money away. All this is cyclical and will pass. Secondly, set up a time for us to go over your portfolio to double-check that you are properly diversified with your investments for your risk tolerance. This will help even out the ebbs and flows you feel through periods of a volatile market. And lastly, update your financial plan. If you do not have a financial plan that you are taking intentional action on, please contact us so we can put one into motion to help you accomplish your goals quicker.

Yours in Wealth,

Josh